Our take on recent climate change legislation

Recently, the United States Congress has signed into law a considerable amount of new government spending programs directed toward addressing climate change in the decade ahead. This is truly welcome news for those who have been eager to see the United States take bolder action in this space...

Here are some of the relevant highlights:

Inflation Reduction Act (IRA) of 2022

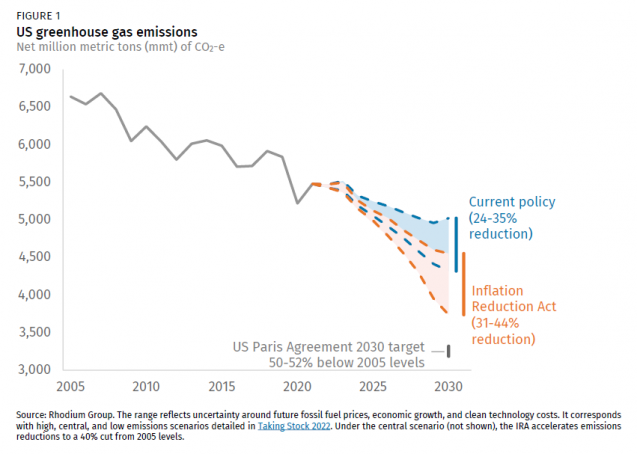

The IRA’s climate provisions are mostly a collection of subsidies for energy that does not emit any carbon, such as solar, wind, or nuclear power. Without those subsidies, polluting fossil fuels are often still cheaper. The subsidies attempt to give cleaner energy an edge. For consumers, the subsidies will reduce the prices of electric vehicles, solar panels, heat pumps, electric stoves, and other energy-efficient home improvements. Businesses can claim credits to replace traditional cars with electric ones, saving as much as 30% on each vehicle’s cost. Other incentives will encourage businesses to build and use cleaner energy. These incentives will last at least a decade, bringing certainty to business planners and investors.

The bill will make cleaner energy and electric vehicles much cheaper for many Americans. Over time, it will also likely make them more attractive to the rest of the world, as more competition and innovation in the U.S. leads to more affordable and better products that can be shipped worldwide.

In addition, the law authorizes $350 billion in additional federal loans and loan guarantees for energy and automotive projects and businesses. This specifically includes financing reinvestment in projects that: (i) retool, repower, repurpose or replace energy infrastructure that has ceased operations; or (ii) enable operating energy infrastructure to avoid, reduce, utilize or sequester air pollutants or anthropogenic emissions of greenhouse gases. These loans, administered by the U.S. Department of Energy, could provide capital for emerging technologies that traditional banks find too risky to lend to.

With incentives and loans to build renewable energy, make agriculture more efficient, promote EVs, and capture carbon, the IRA should bring many more Americans into the clean energy economy by the end of the decade. Domestic economic growth and investments have the potential to fundamentally shift the politics of climate and clean energy in the U.S. due to a broad and diverse set of stakeholders whose livelihoods come from clean-tech sectors kickstarted by this bill.

CHIPS and Science Act of 2022

The CHIPS and Science Act authorized appropriations of $11.2 billion in funding towards R&D for sustainable transportation, advanced manufacturing, industrial emissions reduction technology, advanced materials, and renewable power research, development, and demonstration within the Office of Energy Efficiency and Renewable Energy. It also authorizes appropriations for grid modernization and advanced materials R&D within the Office of Nuclear Energy, clean industrial technologies, alternative fuels, and carbon removal R&D at the Office of Fossil Energy and Carbon Management, and authorizes new funding for the Advanced Research Projects Agency — Energy (ARPA-E). The U.S. Department of Energy will also coordinate information sharing and connect entrepreneurs and startups to various programs related to clean energy technology transfer at the department.

CHIPS and Science Act also increases access to Federal research facilities for startups. Congress authorized $25 million annually to create a program that will provide entrepreneurial fellows with access to national laboratories, expertise, and mentorship to commercialize research ideas. The Department of Energy and national laboratories will provide vouchers to small businesses for R&D, demonstration projects, technology transfer, skills training, and workforce development at national laboratories.

Photographer: Kent Nishimura/Los Angeles Times

The Resilience Fund Perspective

As venture investors in Climate Technologies, we at the Resilience Fund see this new legislation as a complete game changer. Emerging technology markets, especially those with potential for the greater good, often need the help of governments as they cross the chasm from innovative ideas to mass market adoption. Government spending can catalyze early-stage markets, helping fund startups through periods of prolonged R&D before they reach commercial viability. We believe that this is exactly what will happen in Climate Tech in the coming years.

We founded the Resilience Fund at an incredible time. Converging right now are three major inflection points:

We have never seen this level of demand for climate action as corporations, institutions and the general public prioritize sustainability and Environmental, Social, and Corporate Governance (ESG) goal setting.

A wave of breakthrough technologies addressing climate change have emerged, driven by a new type of entrepreneur on an impact mission and armed with innovative business models and plug-in designs that can scale massively.

Now we have major government backing. The United States will catch up to and surpass the commitments made by European nations, who have thus far been leading the way in climate investments.

The actions taken by the United States and other governments worldwide to fight climate change will have a real, tangible impact. Innovative startups will have the option to pursue a new wave of government grants and contracts for their products. Consumers and end market buyers will seriously look at non-carbon energy sources and sustainability products as their costs fall due to government subsidies.

Succinctly put for venture investors, this should have the effect of significantly reducing risk. Time is the most valuable commodity for young companies working through the daily ups and downs of advancing their technologies and achieving product-market fit. While necessary for nearly every company, the pressures of burn rate and capital raises are essentially distractions to the core mission. A reliable revenue and funding source provides the time and resources an entrepreneur needs to see their vision come to fruition. Furthermore, accelerated market readiness, achieved initially through government subsidies, can get startups growing faster.

This next decade has all the makings to be the “Golden Age” for Climate Tech investing. The Resilience Fund is excited to play a role in helping fund the next great technology companies building solutions in the Food, Water, Energy, and Carbon Transformation arenas.

Mike Siegel, David Hertz, and Mark Arnold, founders and general partners of Resilience Fund at the 3rd Annual Climate Investment Summit at the London Stock Exchange.